This is snapshot of those organizations’ lending programs; for more information, visit the microTracker website, or see our forthcoming white paper on the 2013 Microenterprise Census.

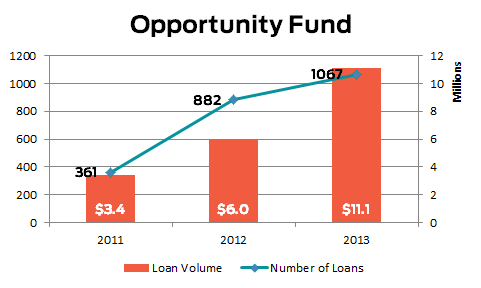

Opportunity Fund has seen the fastest growth among CAMEO’s microlenders, almost tripling the number of loans they made in 2011. They account for more than half of the total lending activity among our member network, and made 1,067 loans in 2013 with a combined volume of $11.1 million; the average loan size was $10,381. This represents a 21% increase over the previous year’s 882 loans, and a 296% increase over 2011. Despite the size of their portfolio, their borrowers pay on time and consistently, with less than 1% of their loan dollars declared unrecoverable at year’s end. They served 1,481 clients.

Opportunity Fund reported $3.33 million in revenue for the microenterprise program last year, supporting 20 FTE staff and 8.9 FTE loan officers. Their average revenue per client was $2,251.

Learn more at Opportunity Fund’s microTracker profile.

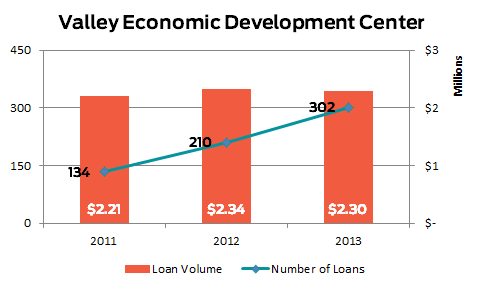

The second largest lender in our network, the Valley Economic Development Center served 1,849 clients in 2013, 302 of whom received microloans totalling $2.3 million. Their average loan size was $7,616. VEDC has also grown substantially over the last three years, more than doubling their number of loans since 2012 while maintaining the quality of their portfolio; less than 3% of the loan dollars were declared unrecoverable last year.

The organization has an annual revenue of $925,000 that supports five full time employees or equivalent, four of whom are loan officers. This is a revenue per client of just $500.

Learn more at VEDC’s microTracker profile!

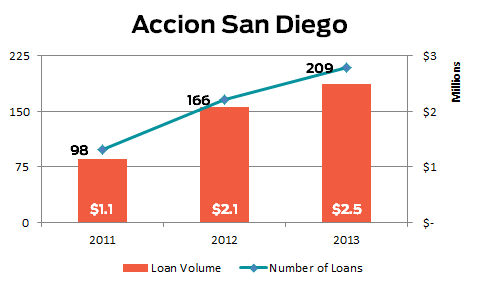

Accion San Diego has also seen consistent growth over the last several years, doubling their lending activity from 2011. In 2013, Accion served 710 clients, and made 206 microloans for a total of $2.5 million. Their average loan size was $11,915. Like our other top lenders, they were able to grow without a huge leap in loan defaults; only 0.6% of their total loan volume was declared unrecoverable in 2013.

Accion San Diego has an annual revenue of $2.02 million dollars, and has 14 full-time or equivalent employees working in its micro program, including 3 FTE loan officers. Their revenue per client ratio is $2,849.

Learn more at Accion’s microTracker profile!