Happy Veteran’s Day. CAMEO salutes those men and women who serve and have served.

In this Must Know…

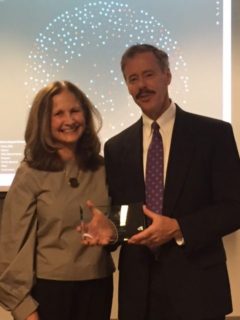

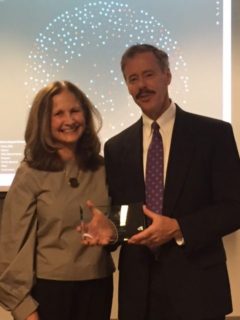

CAMEO is excited to announce that Mark Quinn has joined us as Senior Advisor! (Mark pictured with Claudia in July 2017 at the SBA San Francisco Office)

Mark has worked with CAMEO and CAMEO members extensively during his 40 year federal career. As the District Director for the SBA in San Francisco, he has supported the SBA funding and advocacy to the network of microlenders and SBA resource partners that make up the majority of CAMEO member organizations. Mark will be working with CAMEO on a two year assignment from SBA to continue that support for microbusinesses and independent entrepreneurs and to increase the access to SBA programs for CAMEO members and their clients. We will be giving more details on what projects he’ll be working on after the first of the year – but he’s already been hard at work (see next section).

Congratulations as well to Julie Clowes, who will be the new director of the SBA’s San Francisco District Office. We look forward to working with her!

CAMEO is excited to announce that Mark Quinn has joined us as Senior Advisor! (Mark pictured with Claudia in July 2017 at the SBA San Francisco Office)

Mark has worked with CAMEO and CAMEO members extensively during his 40 year federal career. As the District Director for the SBA in San Francisco, he has supported the SBA funding and advocacy to the network of microlenders and SBA resource partners that make up the majority of CAMEO member organizations. Mark will be working with CAMEO on a two year assignment from SBA to continue that support for microbusinesses and independent entrepreneurs and to increase the access to SBA programs for CAMEO members and their clients. We will be giving more details on what projects he’ll be working on after the first of the year – but he’s already been hard at work (see next section).

Congratulations as well to Julie Clowes, who will be the new director of the SBA’s San Francisco District Office. We look forward to working with her!

- Welcome, Mark Quinn!

- CAMEO Helps Microbusiness in Northern California

- Tax Reform Continues – Take Action

- Read our op-ed published in The Hill – “Tax reform for the growing gig economy.” – for a good summary of the proposals we would like to see.

- The Goodies – This week’s highlight is that open enrollment for Covered California 2018 began on November 1st, and is open through January 31st, 2018. Covered California is the only insurance marketplace in California where eligible consumers can receive financial assistance to help pay for their health insurance. (So important, worth repeating!)

Welcome, Mark Quinn!

CAMEO is excited to announce that Mark Quinn has joined us as Senior Advisor! (Mark pictured with Claudia in July 2017 at the SBA San Francisco Office)

Mark has worked with CAMEO and CAMEO members extensively during his 40 year federal career. As the District Director for the SBA in San Francisco, he has supported the SBA funding and advocacy to the network of microlenders and SBA resource partners that make up the majority of CAMEO member organizations. Mark will be working with CAMEO on a two year assignment from SBA to continue that support for microbusinesses and independent entrepreneurs and to increase the access to SBA programs for CAMEO members and their clients. We will be giving more details on what projects he’ll be working on after the first of the year – but he’s already been hard at work (see next section).

Congratulations as well to Julie Clowes, who will be the new director of the SBA’s San Francisco District Office. We look forward to working with her!

CAMEO is excited to announce that Mark Quinn has joined us as Senior Advisor! (Mark pictured with Claudia in July 2017 at the SBA San Francisco Office)

Mark has worked with CAMEO and CAMEO members extensively during his 40 year federal career. As the District Director for the SBA in San Francisco, he has supported the SBA funding and advocacy to the network of microlenders and SBA resource partners that make up the majority of CAMEO member organizations. Mark will be working with CAMEO on a two year assignment from SBA to continue that support for microbusinesses and independent entrepreneurs and to increase the access to SBA programs for CAMEO members and their clients. We will be giving more details on what projects he’ll be working on after the first of the year – but he’s already been hard at work (see next section).

Congratulations as well to Julie Clowes, who will be the new director of the SBA’s San Francisco District Office. We look forward to working with her!

CAMEO Helps Microbusiness in Northern California

Mark Quinn was working with the SBA Office of Disaster Assistance in Houston in the recovery efforts for Hurricane Harvey when the Northern California fires happened. His work in Houston was near an end and home called. For the past several weeks Mark has been working in NoCal to support CAMEO member organizations in delivering disaster-related services and doing outreach to non-member organizations to connect them with small businesses resources in the CAMEO network. Of particular importance is explaining SBA’s Disaster Business program features. Many microbusinesses and non-profits are unaware that SBA Disaster programs provide both physical disaster loans and Economic Injury Disaster Loans (EIDL). EIDL loans assist those firms where they did not experience damage to the business property but incurred loss to their business revenues. Businesses like caterers where events were cancelled or landscape firms where they’ve lost customers can apply for an EIDL for working capital to bridge their financial loss until revenues rebound. Mark has met many microbusinesses that have been affected and is connecting those that are eligible to SBA loans. But many of these small businesses are not eligible for SBA loans for one reason or another; Mark is connecting them to CAMEO resources. For example, a lot of construction-related businesses will pop up over the next few months that may need business coaching and loans, like the heavy equipment operator whose employer burnt down and wants to start his own business. Some of Mark’s activities include: connecting CAMEO organizations to SBA/FEMA to provide staff briefings on programs, providing direct one-on-one assistance for CAMEO member clients needing guidance on their program eligibility, conducting town halls and participating in resource event. He’s working with our Northern California members – Napa/Sonoma Small Business Development Center, WEST Company, Community Action Partnership of Sonoma County, Community Development Services, EDFC Mendocino County, Working Solutions and Opportunity Fund. If other members are working on disaster assistance for businesses, please let us know so that we can send Mark your way. CAMEO is honored to support its members in these unique circumstance and to provide them and their clients with resources that otherwise may not be readily available. For those clients that CAMEO members have invested significant assistance to help them start and grow, this effort will help ensure that those clients impacted by disaster receive priority in navigating recovery assistance to continue to thrive. Grantmakers Concerned with Immigrants and Refugees lists other organizations and funds that are rebuilding Northern California:- FEMA Application for Disaster Relief

- California Assistance and Services for Disaster Recovery

- Benefits.gov Disaster Relief Resource

More on Tax Reform – Take Action

We’re still waiting for tax reform efforts to include the 70 million people in the U.S. economy that are receiving 1099 forms and doing some kind of independent work, whether full-time or part-time. The following articles explain what we want in tax reform.- CAMEO’s op-ed published in The Hill – “Tax reform for the growing gig economy“.

- “Demanding Tax Reform for Our Rapidly Evolving On-Demand Workforce,” a recap of our event last month on the Intuit blog.

- Etsy also weighs in – “Gig economy too important to be left out of tax reform plans“.

Click to Tweet: Taking the High Road creates sustainable, positive and prosperous workplaces #HighRoadWorkplace https://ctt.ec/Z3oIU+ @ASBCouncil** CALED is opposing the elimination of Private Activity Bonds. State and local government have used these bonds to catalyze investment in business industry, and infrastructure for over 100 years. Elimination of this program would have significant impact on economic development in California. These are used to fund critical and important public facilities and infrastructure, including hospitals, schools, highways, bridges, railways, water and sewage facilities, energy facilities, low-income housing, and countless others. California is one of the largest issuers of these bonds. By eliminating Private Activity Bonds, the ability of California to finance these projects will also be eliminated, as governments and project sponsors will be forced to borrow at higher interest rates. Read the CDFA Letter. If you agree, you can take two minutes and sign the letter. **The initial bill from the House Ways and Means Committee repeals the New Markets Tax Credit (NMTC) and terminates the final two years of NMTC allocations, which were authorized through 2019 under the PATH Act passed by Congress in 2015. OFN is asking that you take action to preserve the NMTC.